When it comes to SARs, the NCA's UK Financial Intelligence Unit (UKFIU) is doing its level best to push an ever-heavier boulder up an ever-steeper hill.

In its recently published 2021 and 2022 stats, making headlines: the rapid rise in the total GBP value denied to suspected criminals.

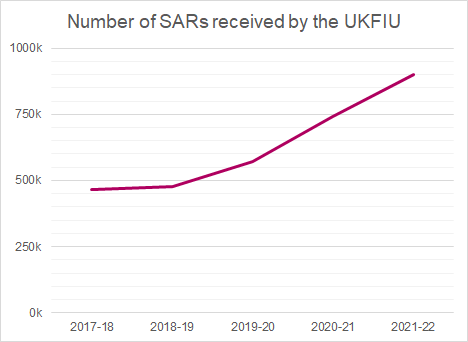

But the number of SARs the UKFIU is receiving is rapidly rising too. Banks, building societies, credit unions and electronic payment firms are major contributors to this.

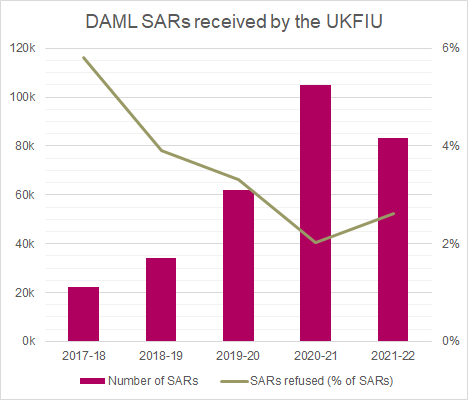

And the number of DAML SARs is elevated. Meanwhile, the % of DAML SARs being refused has declined year-on-year, with only a modest rise in the last year.

Facing greater SARs volumes - some of which perhaps filed out of abundance of caution - the SARs Reform Project can't deliver soon enough for the UKFIU and industry. Bring on the UKFIU's new SAR portal and bulk API technology. And here's hoping the UKFIU can grow its headcount with necessary expertise to manage its ever-growing workload effectively.

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-03-06-15-52-32-272-69aaf8405d1c81351d450b21.jpg)

/Passle/60746e77e5416b13f482811b/MediaLibrary/Images/64c144b4a200c5aef90d9a23/2023-07-27-09-24-40-230-64c237d8cb7eed22ccf22857.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-03-05-14-23-25-799-69a991dd166e0c790a34bce6.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-27-12-41-28-752-69a190f85417270d30ad4cd2.jpg)