In this post we drew upon the FCA's 2022-23 Annual Report and asked: given the FCA's rising case numbers, is the FCA actually managing to intervene more frequently?

When it comes to Threshold Conditions, Interventions (OIREQs and VREQs) and Enforcement, the answer is - in many cases - no.

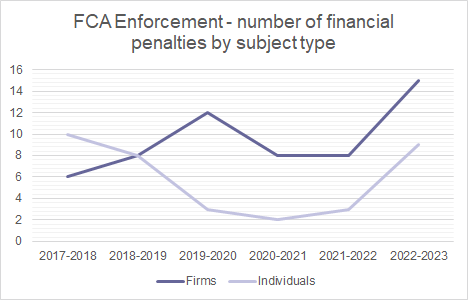

Whilst the number of financial penalties is up, the total £ value of penalties is down - suggesting that FCA Enforcement is making greater headway against smaller firms.

Speaking of smaller firms, the number of Skilled Person reports is pretty steady year-on-year, with the 2022-2023 confirming that the FCA will use them far more frequently in respect of Portfolio Supervision firms than Dedicated Supervision firms.

Highlights from specific subject areas:

- On market conduct, the FCA confirmed that in the last year it commenced legal action re market disclosures in two cases (in addition to its two Decision Notices against listed companies and their directors); taken action against a director for unlawful disclosure of inside information; charged 5 individuals for insider dealing; and have a market manipulation case before the Upper Tribunal.

- Following live and post-event surveillance of listed company disclosures, the FCA suspended listings on 34 occasions and there were 54 clarificatory statements to the market following FCA contact.

- The FCA used its insolvency powers to make 10 applications in calendar year 2022 (1 in 2021) - 8 of which were winding-up petitions.

- And the FCA notes that in January 2023 it issued a statement of objections to 3 parties re suspected anti-competitive arrangements in money remittance services; and issued 9 "on notice" letters.

- More financial crime action is promised:

- On AML enforcement in particular, the FCA recognises that its financial crime case pipeline is subdued at present, but promises to "increasingly focus" on AML enforcement, following an increase in its level of AML supervisory work.

- And the FCA reports its successful co-operation with a Regional Organised Crime Unit tackling an unregistered cryptoasset business, apparent money laundering and other offences, leading to over £3m in restraining orders and a halt to illegal crypto-exchange activity and disruption to a serious organised crime unit; as well as action against illegal crypto ATMs.

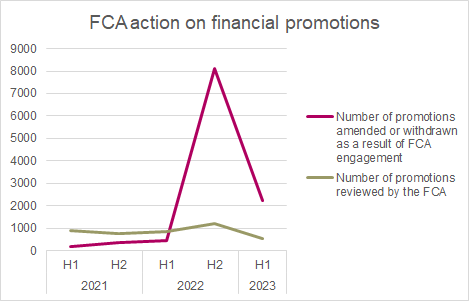

- And on financial promotions the FCA has seen some success:

Read more about the FCA's rising case numbers, its internal changes (and its hiring spree), and its results policing the perimeter and addressing unauthorised entities.

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-20-37-20-643-698ce880144613bb0df722ae.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-15-31-57-306-698ca0ede9532677a0cc8ba9.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-10-17-28-26-585-698b6aba93123fc2fd53875d.jpg)