In this post we drew upon the FCA's 2022-23 Annual Report and asked: given the FCA's rising case numbers, is the FCA actually managing to intervene more frequently?

When it comes to policing the perimeter, the answer is yes.

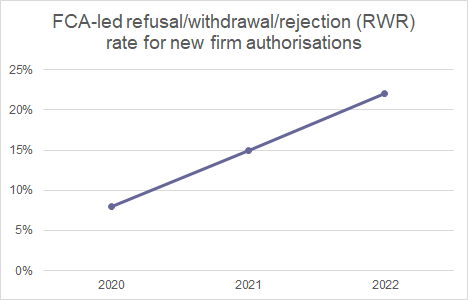

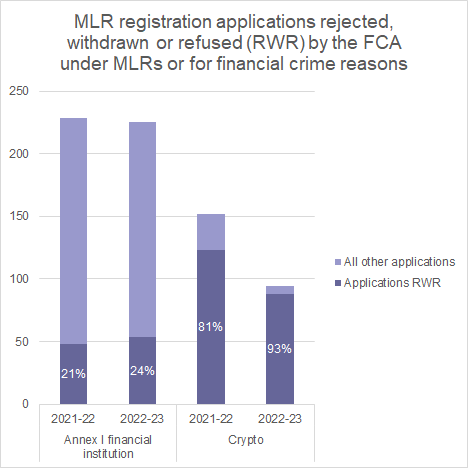

The FCA has increased its refusal/withdrawal/rejection (RWR) rates for new firm authorisations and for MLRs registrations:

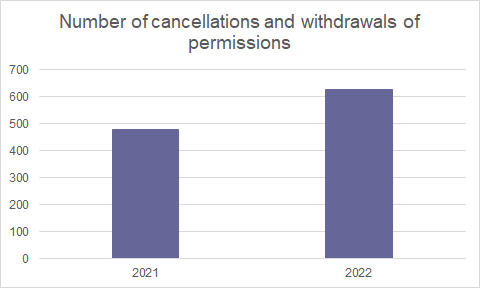

It has increased the number of cancellations and withdrawals of permissions (likely driven in part by the FCA's Use It Or Lose It initiative):

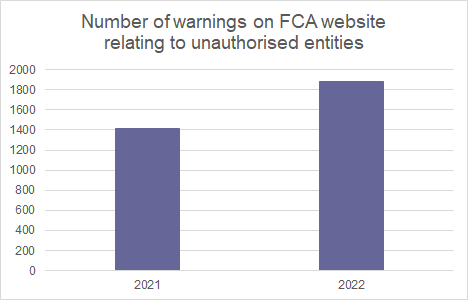

And it's issuing more warnings about unauthorised entities:

Defend the keep!

The FCA makes much hay of its redoubled efforts to protect the perimeter against poor candidates for authorisation. It touts its "strengthened authorisation process" which will "limit the ability of bad actors to enter our financial system". It says it has increased investment in its unauthorised business enforcement teams.

And it foreshadows that its two new Executive Directors of Enforcement "will review our approach to firms that do not meet our standards". In service of efforts against such firms, it has "recruited 3 additional teams". And it is using "additional data sources" to improve its detection of firms in breach of complex Threshold Conditions.

On the subject of unused permissions, the FCA reports the completion of its Cancellation of Firm Authorisation Project, which automated the identification of firms for cancellation of permissions, largely because they were unused.

Read more about the FCA's rising case numbers, its internal changes (and its hiring spree), and its results on Threshold Conditions, Interventions (OIREQs and VREQs) and Enforcement.

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-20-37-20-643-698ce880144613bb0df722ae.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-15-31-57-306-698ca0ede9532677a0cc8ba9.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-10-17-28-26-585-698b6aba93123fc2fd53875d.jpg)