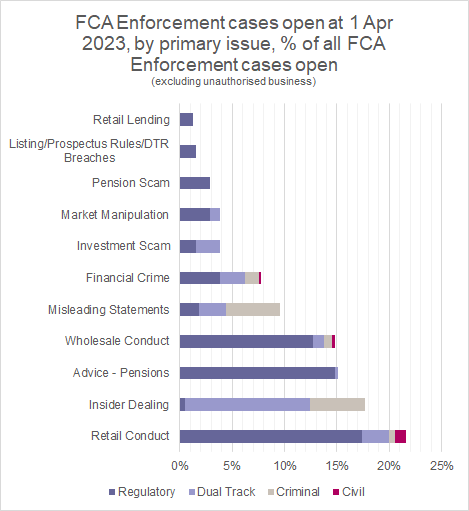

Here's what FCA Enforcement is focused on now, according to stats in the FCA's 2022-23 Annual Report:

Changing tack

The latest stats also show that FCA Enforcement's case pipeline is stalling. The number of cases opened is back down to 2016 levels. But so is the number of cases closed. Which means the number of open cases at year end hasn't changed much.

Looks like the FCA's priority lies elsewhere: in supervisory interventions. When it comes to open cases at year end, there's a marked increase in Interventions (OIREQs and VREQs) and Threshold Conditions cases.

"Cases" and "enquiries"

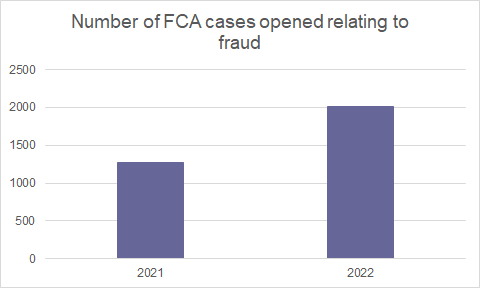

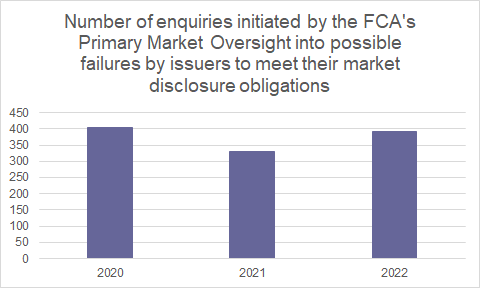

Alongside this, the FCA is reporting "cases" opened relating to financial crime and fraud, and "enquiries" initiated by FCA Primary Market Oversight into market disclosure issues. "Cases" and "enquiries" aren't formally defined, but are likely to constitute supervisory engagement with firms to obtain information more informally than Enforcement investigations or Interventions cases. The FCA also reports that it reviewed nearly 100 suspected sanctions breaches last year and introduced a data-led approach to proactive sanctions supervision including use of synthetic data to test firms' sanctions-screening systems.

Underlying these ramped-up case numbers there are a number of changes the FCA is making internally - you can read more about those here (and as a bonus you can also read about the FCA's hiring spree).

But what does it all mean?

There's a lot of ongoing activity. But that's not the whole story. You see, it could be that increasing open case numbers is a symptom of the FCA struggling to progress its caseload.

So: is the FCA actually managing to take action more frequently?

Well, it's a mixed picture. But in some areas, yes - so get prepared. Read more about:

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-20-37-20-643-698ce880144613bb0df722ae.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-15-31-57-306-698ca0ede9532677a0cc8ba9.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-10-17-28-26-585-698b6aba93123fc2fd53875d.jpg)