The FCA has published the results of its review of costs transparency in firms offering money remittance and cross-border payment services. The FCA reviewed the websites of a sample of firms to understand how they were communicating pricing information prior to transfers being made, along with their interaction with reference rates.

There is a particular focus on how fees – particularly additional or ‘hidden’ fees – are communicated. This means that the feedback will be relevant to all firms offering paid-for services in which various fees may be charged across the distribution chain. The FCA has provided some examples focused on pre-sale communications which give firms an example of what good looks like in this context.

Although positioned as a review of communications, the feedback also reflects the FCA’s wider concerns that customers may not be receiving good value, as they are not getting the service for which they believe they have paid (see further here and here).

Where to start?

The review outlines the FCA’s starting point as follows:

| Consumer Duty customer understanding outcome requirements: |

|

| Obligations on money remittance firms before a transaction takes place: | Ensure that:

|

| Information the FCA expects firms to provide: |

|

| Weaknesses identified during the review: | Firms were not always clearly displaying the amount recipients would receive relative to the original amount being remitted. This prevented customers from comparing prices and making informed decisions. In addition:

|

Moving forward and best practice

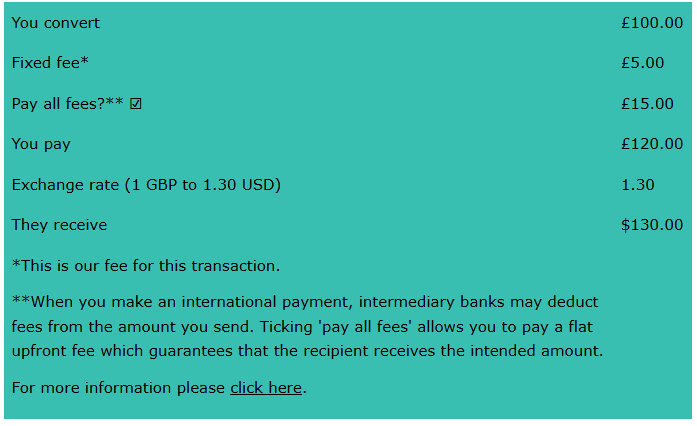

The FCA published examples of poor and good practice for remittance payments involving fixed fees, variable fees and third-party fees. These can be found in more detail here and are worth reviewing. A summary of the key elements of good practice is set out below.

| Fee structure | Examples of good practice | FCA observations |

| Fixed fee offerings |   | The amount actually being converted is clear. Customers can see clearly whether any fee charged is added to, or deducted from, the amount they pay.

|

| Variable fees |   | The communications about variable fee structures are clear, ensuring pricing transparency. All fees are totalled to provide a clear and comprehensive view of the overall cost. |

| Third party fees |

| The customer sending money can see that intermediary / recipient bank fees or taxes may be deducted, making it clear that their recipient might receive less than the original transfer amount. Links to additional information help customers understand and estimate fees. Where firms are unable to calculate (or estimate) the amount that the recipient would receive (due to intermediary or recipient bank fees), there is a clear message that additional fees may apply. |

International payments through the lens of the Duty

Many of the elements of ‘poor practice’ identified by the FCA here could have been anticipated by firms with a clear understanding of what a good outcome for customers of money remittance services looks like.

A reasonable starting point would be that customers would expect their recipients to receive as much as possible (if not the entirety) of the money they send. They will also want to be able to make an informed decision about the amount of any fees that they pay.

In terms of target market, it is likely that some users of this type of service will experience additional barriers to understanding, such as having English as a second language. Given this, it is foreseeable that some customers at least might be confused by opaque fee charging structures and practices. Clear communications - tested where appropriate and supported by evidence that they are capable of being understood by the average customer in the target market - are therefore a crucial means of mitigating the risk that firms offering international money transfers cause foreseeable consumer harm.

Are the examples helpful?

Yes, but only to a point. The Duty is designed to give firms flexibility over how they achieve ‘good outcomes’ for their customers. On that basis, the FCA’s clear examples of what it considers to be good practice is helpful. However, the more often the FCA provides examples of what ‘good’ looks like, the greater the risk that this is taken by firms as the only way to deliver a good outcome in the relevant context. The FCA does stress that firms whose disclosures look more like the ‘poor practice’ examples might not necessarily be in breach of the Duty, but they will presumably need to have a good argument for why their communications are still meeting the required standard.

Much depends on how the FCA approaches supervision here. If good practice becomes prescriptive, much of the potential of the flexibility afforded by ‘outcomes focused’ regulation could be lost.

[1] PRIN 2A.5.3R

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-19-14-31-45-735-69971ed1ed31acc93b157572.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-20-37-20-643-698ce880144613bb0df722ae.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-11-15-31-57-306-698ca0ede9532677a0cc8ba9.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-10-17-28-26-585-698b6aba93123fc2fd53875d.jpg)