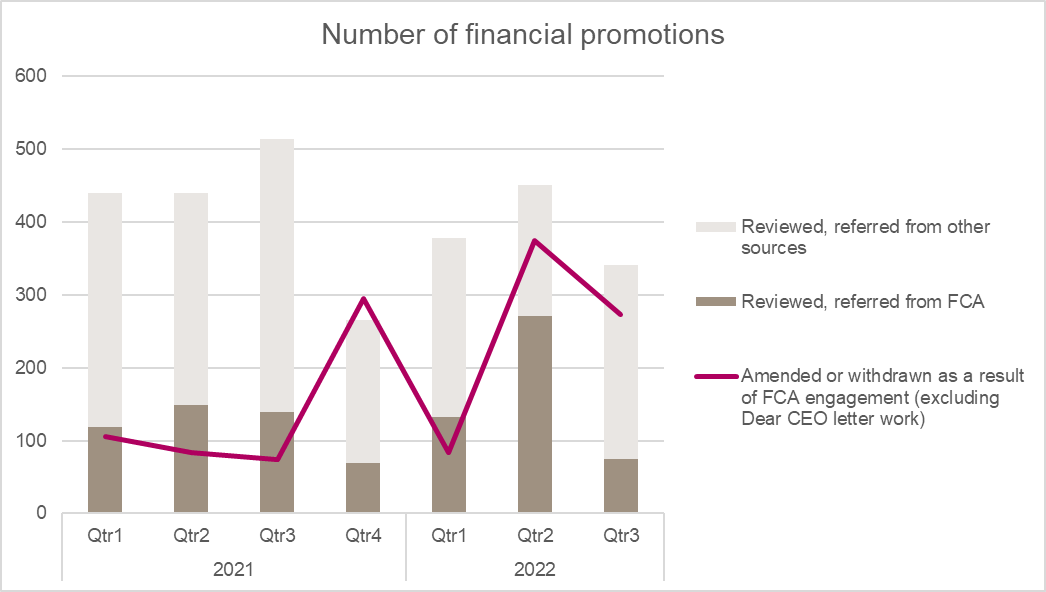

Compared to previous quarters, in 2022 Q3 the FCA apparently got an awful lot more efficient at getting financial promotions amended or withdrawn.

| Average per quarter (2021 Q1 - 2022 Q2) | 2022 Q3 | |

| Number of financial promotions amended or withdrawn as a result of FCA engagement | 169 | 4,151 |

| ... per promotion the FCA reviewed | 0.5 | 12.2 |

| ... per financial promotions case the FCA opened | 6.0 | 112.2 |

So, how did they achieve it? And what's their game now?

Hello, CEO

The FCA has a new favourite tool here: Dear CEO letters.

In 2022 Q3, 93% of amended/withdrawn promotions were as a result of the FCA's May 2022 Dear CEO letter to almost 28,000 lenders and brokers.

Quickly seeing the potential, the FCA in August 2022 issued another Dear CEO letter, this time to 27,000 firms about Buy Now Pay Later (BNPL) financial promotions. No doubt this will start showing up in the forthcoming 2022 Q4 data.

Changes afoot

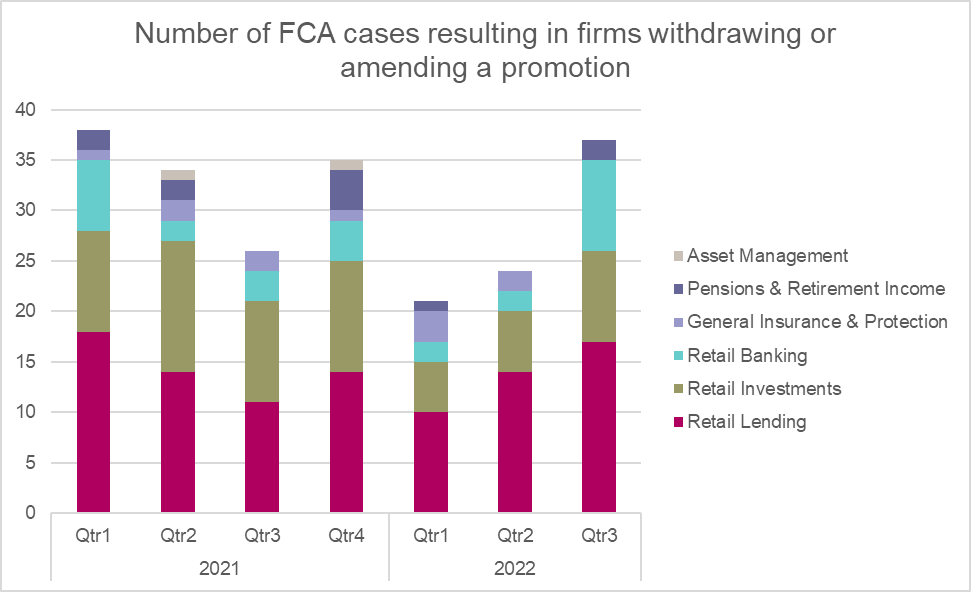

Taking the Dear CEO letters out of the picture, the FCA's financial promotions work is a bit all over the place. (Charts below for those who like them.)

- It's actually reviewing fewer promotions, mostly because it's getting less promotions referred to it by FCA monitoring or other FCA teams.

- But it's as busy as it has ever been the last couple of years when it comes to cases resulting in amendments/withdrawals, and the number of promotions amended/withdrawn.

Another puzzle.

Both barrels

Here's my best guess at what's happening. The FCA is pivoting away from market-wide monitoring for issues with individual promotions (sounds like hard work anyway) and instead is taking a two-pronged strategy:

- Looking at single (possibly larger) firms' campaigns involving multiple promotions. The FCA will open a case if it wishes to address an issue here.

- Generally spot-checking promotions sector-by-sector to identify potential systemic issues. The FCA will use Dear CEO letters to address those issues.

But: will the FCA's Dear CEO letters work generate more potential cases? How will it triage those cases? Will its case teams keep up? Watch this space…

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-03-06-15-52-32-272-69aaf8405d1c81351d450b21.jpg)

/Passle/60746e77e5416b13f482811b/MediaLibrary/Images/64c144b4a200c5aef90d9a23/2023-07-27-09-24-40-230-64c237d8cb7eed22ccf22857.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-03-05-14-23-25-799-69a991dd166e0c790a34bce6.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-27-12-41-28-752-69a190f85417270d30ad4cd2.jpg)