From an interventions and enforcement perspective, the PRA's annual report is fairly brief as usual.

The FCA's annual report gives a little more away - in it the FCA demonstrated its primary focus on financial crime, fraud and scams, and obtaining redress in particular for retail customers. Whilst various formal enforcement actions were highlighted, the real trend is in the higher volume of supervisory initiatives including financial crime cases, AML and sanctions assessments, cancelled authorisations and detecting and acting against potentially misleading promotions. Further, the FCA reported that it is using the Consumer Duty in a supervisory context, leading to firms suspending operations, giving redress, or exiting the market altogether; and that its supervisory interventions in the Authorised Representatives (ARs) context has led to the termination of over 400 AR relationships and 32 principals voluntarily restricting their business.

Sometimes the real story is in the stats, though, and here are a few of note.

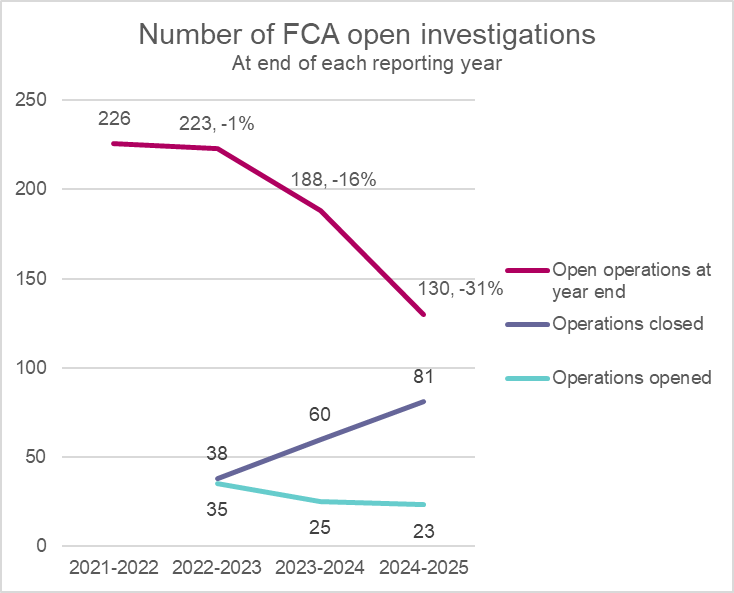

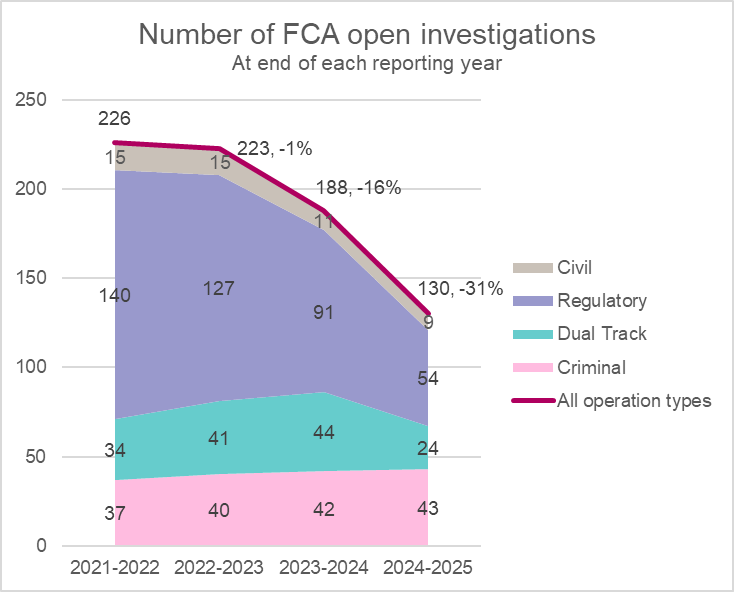

FCA investigations

The FCA's recent rationalisation is clear, driven by a shrinking regulatory and dual track investigation caseload (fewer opened, more closed).

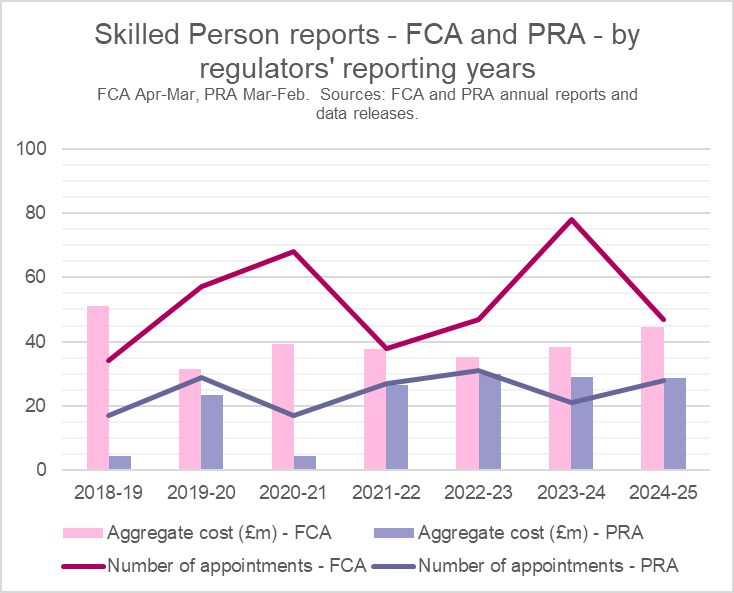

Skilled Persons

The FCA might not, after all, be using Skilled Person commissions to alleviate pressure on its own investigators. Interesting.

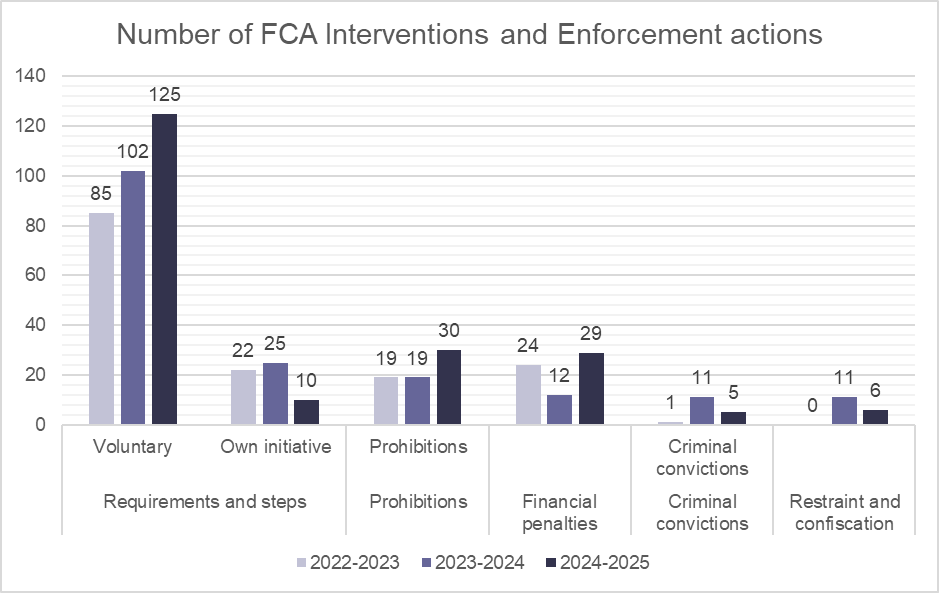

FCA supervisory interventions

The FCA continues to ramp up its use of its voluntary and own-initiative requirements powers.

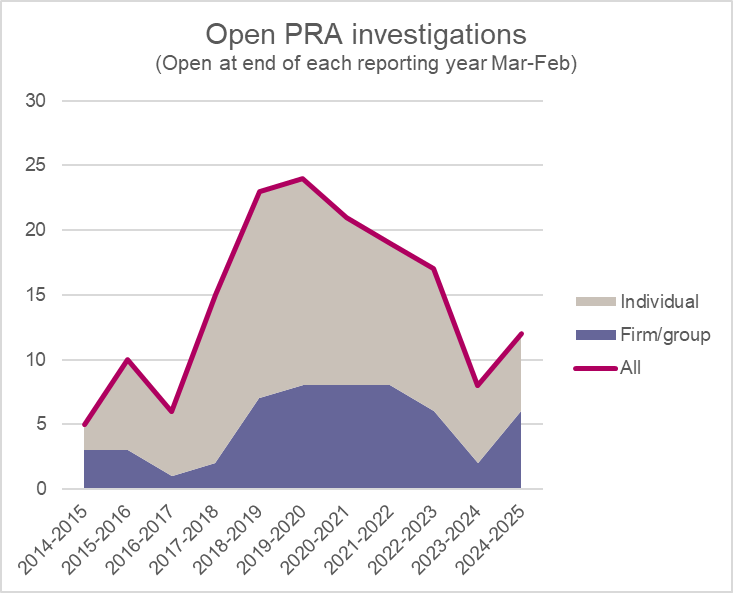

The PRA

And the BoE/PRA may be the dark horse in the race. PRA investigations have ticked up a little. And the BoE's bringing new enforcement powers online.

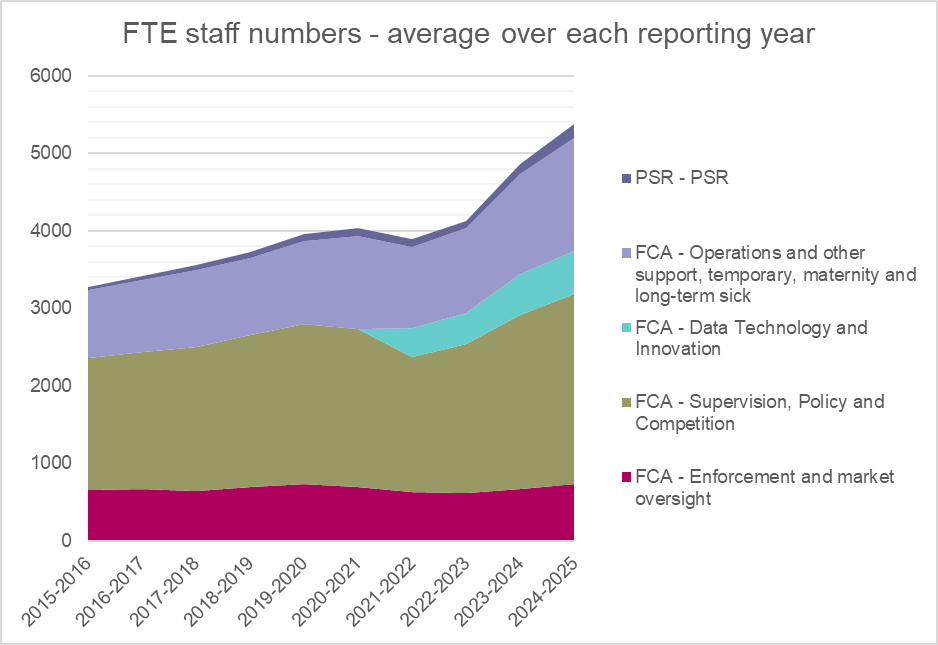

FCA resourcing

This is how the FCA is getting all that supervisory work done. With more people. Many more people.

Interestingly, Enforcement is growing too - up 10% in full time equivalents since last year. Watch this space?

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2025-12-17-11-07-01-724-69428ed55657195f590ed8d2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-27-12-41-28-752-69a190f85417270d30ad4cd2.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-26-12-02-30-970-69a03656051641e74b37d5c6.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-26-10-34-58-651-69a021d284138579a558bf06.jpg)

/Passle/60746e77e5416b13f482811b/SearchServiceImages/2026-02-25-15-19-42-638-699f130eb208a223bd09506a.jpg)